.jpg)

Cash is King for Property Investment

Cash is King for Property Investment

Despite the slow capital growth in some residential areas, property continues to deliver a good return on investment.

Overall, rents have remained steady in most regions giving investors income to pay mortgages and expenses. Cash is vital for all businesses including property. The better your cash flow, the easier it is to manage your investments.

Property Tax Depreciation is simple and rewarding but often overlooked by investors as a means of increasing cash flow. Capital allowances enable investors to reduce their income tax further. Potentially investors can claim thousands in depreciation deductions for building, and plant and equipment items for up to 40 years.

Reminder Changes to Depreciation law on Second-hand and New Residential Properties

Legislative changes have restricted depreciation allowances for existing or second-hand residential properties purchased after the 9th May 2107. Since then, investors can claim allowances on second-hand properties for building or structural improvements (Division 43), and newly purchased plant and equipment items (Division 40).

Second-hand properties purchased before the 9th May 2017 and used as investment properties will continue to be eligible for depreciation allowances for both the Building and Plant and Equipment items.

Newly built properties attract depreciation allowances for both building and plant and equipment items. In this regard, newly built properties are more profitable as these will deliver you the most depreciation deductions.

Calculate your Cash Flow

Without a doubt, the higher the cash flow, the more profitable is your investment. Claiming depreciation deductions gives you the chance to receive extra funds through your income tax, so you can reinvest in your property or enjoy.

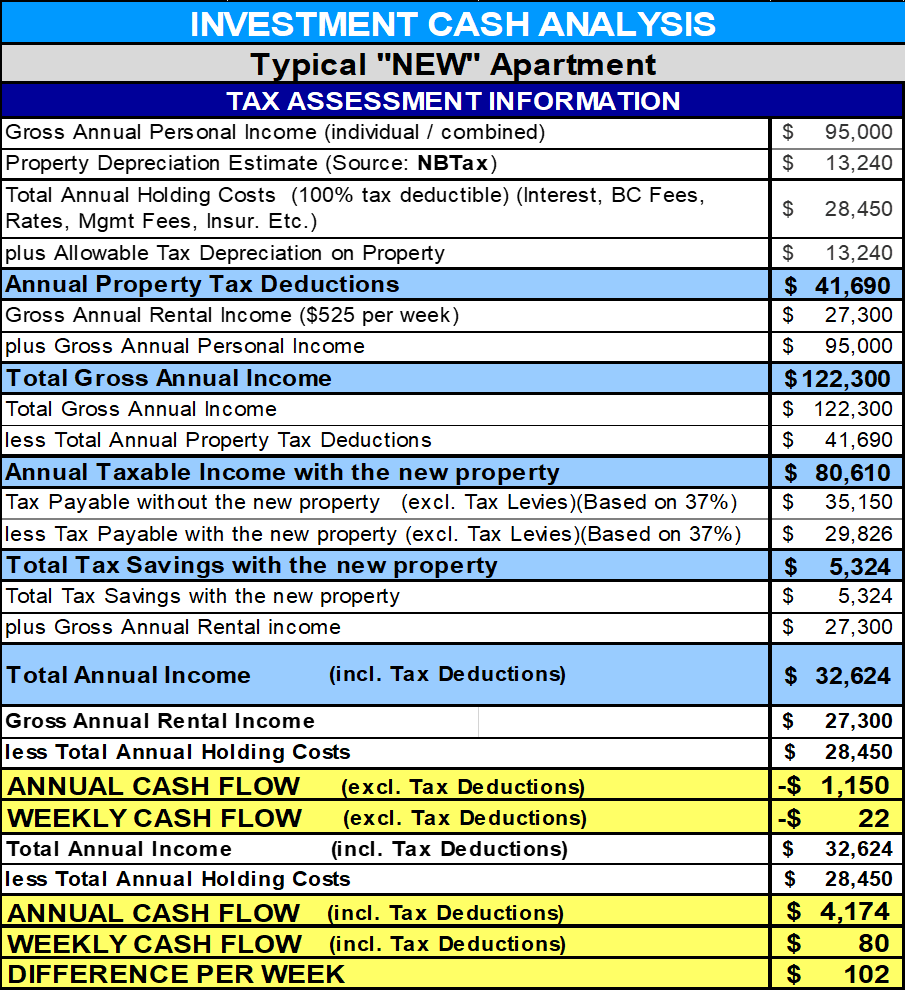

Here is a simple table showing the additional cash flow resulting from typical depreciation deductions of approximately $13,240 on a newly built apartment in the first year.

The depreciation estimate takes into account 2.5% on the building structure, plus plant and equipment including white goods, flooring, security system, and a share of the building lift and common areas.

EACH YEAR you could gain up to an additional $4,174 in cash. This is certainly worth the effort, and the small once only cost of a depreciation schedule

How NBtax by Napier & Blakeley helps you…

Finding the right property tax advisor is important to safeguard your wealth. Our business is built on trust and developing honourable relationships. Our job is to ensure our clients are able to utilise all depreciation allowances associated with this property.

It’s been our privilege to have helped investors maximise their tax deductions through depreciation since 1985, saving our clients millions of dollars over this time. Our qualified and experienced team of Quantity Surveyors provide comprehensive and accurate depreciation schedules with all eligible deductions included. The Australian Tax Office requires depreciation schedules to be prepared by Registered Tax Agents such as our Quantity Surveyors. A comprehensive and quality depreciation schedule will help your accountants to include all eligible deductions with your income tax return.

Our focus is on the details. Site inspections are another factor vital to compliant reporting. A detailed inspection substantiates the assets and value of the property, and ensure we claim every possible deduction. We photograph and document our inspections to verify our claims in case of an audit. It’s all about maximum return and peace of mind.

In our experience, depreciation schedules are a sound investment, returning significant savings, and providing an accurate benchmark to measure the profitability of your investment property for future years.

Can you afford not to engage the best? Build your wealth by making significant savings and increasing your cash flow for your residential investment properties through depreciation. Order your schedule today.