Depreciation Allowances Deliver Huge Rewards for Investors of Collins St Residential Apartments at Victoria Harbour

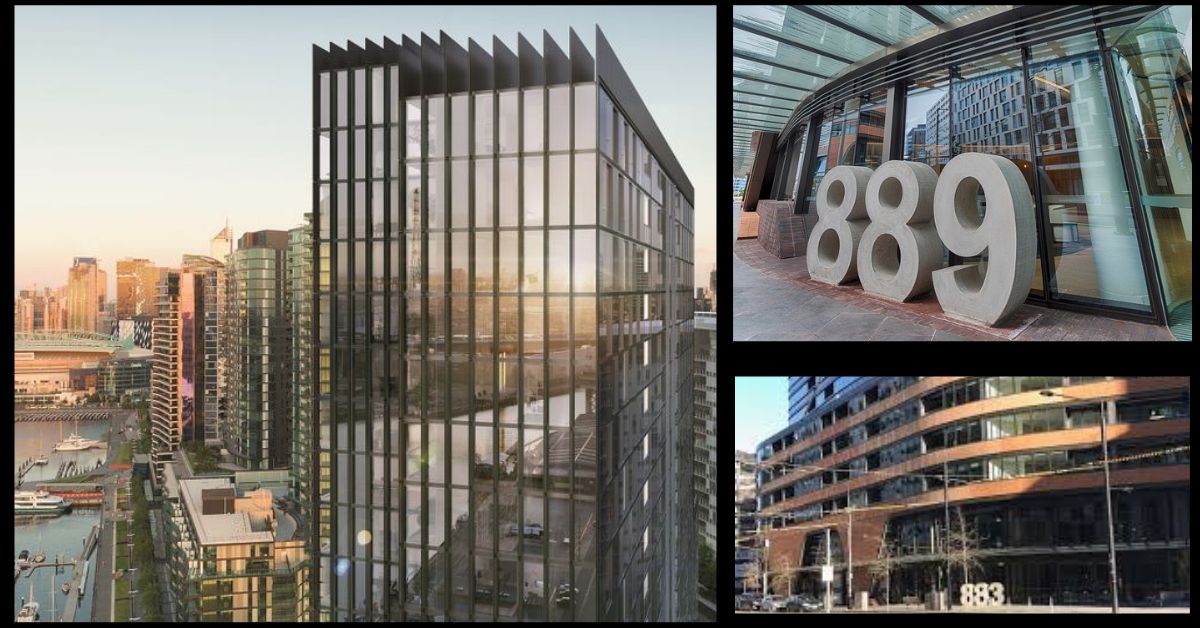

The multi-billion dollar Victor Harbour precinct developed by multi-national Lendlease is a stunning example of a new style of residential living. Our NBtax team has been involved with all three stages of the development including No. 1 Collins Street, 883 Collins Street and 889 Collins Street.

Each of the apartment complexes have proven extremely popular with home owners and investors featuring high end fittings and fixtures. Our clients have benefited from being able to offset rental earnings by claiming depreciation on both the Building (Division 43) and Plant & Equipment Assets (Division 40). Throughout the development, we’ve provided hundreds of depreciation schedules delivering thousands of dollars for each investor in personal income tax savings.

Our clients have benefited from the experience and knowledge of our Quantity Surveyors and Tax Analysts who have worked extensively with property tax legislation and the construction industry generally. Our team focus on accurately calculating all relevant assets and expenses involved in the purchasing and construction of properties to help investors maximise their investments.

Our reports detail comprehensive lists with precise calculations of current and future values for all Plant & Equipment items allowable under Division 40, for the life of the assets.

It’s extremely important investors use only qualified and experienced Tax Analysts to ensure they are compliant with the law. Our property tax division has been audited by the Australian Tax Office (ATO) and found to be compliant. The ATO is reviewing deductions for investment properties closely. We guarantee our clients’ depreciation claims are compliant and won’t risk providing noncompliant depreciation schedules.

Given the recent changes to the Effective Life of Plant & Equipment Assets which came into effect on 1 July 2019, we urge investors to keep accurate records of capital works and new asset purchases.

The amendments involved changes or additions to 32 items on the Effective Life asset list. Owners of existing investment properties will NOT be impacted, as the legislation is grandfathered. Any new equipment purchased from 1st July 2019 for improvements to existing residential properties will be subject to the new Effective Life ruling. To learn more head to Changes to Effective Life of Assets