Investment House Vs Unit - Which delivers better depreciation returns?

I am looking at buying my first investment property this year, and a friend has advised me to purchase a unit instead of a house for better depreciation benefits. I don’t quite understand how this works: houses are bigger, therefore shouldn’t the depreciation returns be higher? I would love some advice before I invest, as I’m aiming to keep my cash flow position as strong as possible (ideally, I want a neutral or positively geared investment). Thanks, Dale".

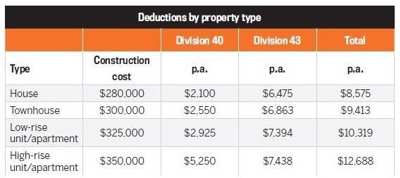

Residential investment properties are usually classified into four main

types of building: residential houses, townhouses, apartments or units

(low-rise and/or high-rise). All these do allow you to obtain different

types of capital allowance deductions. If you are claiming under Division

40 on the above brand-new properties, you are generally entitled to claim

the following percentages of the construction costs as a capital

allowance:

Residential investment properties are usually classified into four main

types of building: residential houses, townhouses, apartments or units

(low-rise and/or high-rise). All these do allow you to obtain different

types of capital allowance deductions. If you are claiming under Division

40 on the above brand-new properties, you are generally entitled to claim

the following percentages of the construction costs as a capital

allowance:

a. Residential houses: 5–10%

b. Townhouses: 5–15%

c. Units/apartments, low-rise: 5–15%

d. Units/apartments, high-rise: 10–20%

The above percentages are a standard benchmark for fittings and plant and

equipment that qualify for a deduction and do not include any special

fittings such as vacuum-ducted systems, electronic blinds, solar panels,

high-quality kitchen white goods, etc.

The above percentages are a standard benchmark for fittings and plant and

equipment that qualify for a deduction and do not include any special

fittings such as vacuum-ducted systems, electronic blinds, solar panels,

high-quality kitchen white goods, etc.

You can also be entitled to a higher-percentage claim for units/apartments (high-rise), as you are allowed to claim your portion of the common property for items such as lifts and basement ventilation.

In addition to the above, if you purchase any new furniture to fitout your investment property, this generally can all be claimed in the first seven years. With all these properties, in addition to Division 40 Capital Plant allowances, you are also entitled to claim under Division 43 which is the construction cost of the property from the date its construction was completed. The size, location, and construction cost of the property will dictate what you can claim as a deduction for capital allowances. In addition, you may be able to claim your entitlement to common property for the next 40 years.

Another factor to consider when chasing deductions is that if you purchase in a hotel/motel or a short-term accommodation strata-tiled property, the capital works are depreciated at 4% per annum of construction costs and not 2.5%. These investments usually come with a furniture package, which further enhances your total deductions to be claimed.

In most cases, you’ll receive greater depreciation deductions for new

properties. High rise apartments offer additional depreciation

allowances as more items can be included such as lifts.

In most cases, you’ll receive greater depreciation deductions for new

properties. High rise apartments offer additional depreciation

allowances as more items can be included such as lifts.

What you need to know:

• All building types allow you to obtain different types of capital allowances deductions.

• You can maximise depreciation deductions by buying a new high-rise apartment.

• New furniture bought for your investment property can generally be claimed in the first seven years

Remember to order your depreciation schedule to include with your tax return now. Gain more tax benefits and avoid penalties from inaccurate depreciation reports.