Luscious Luxury Resort Style Home Delivers Rich Returns

Many luxury resort style properties, especially those aimed at holiday makers include a substantial quantity of high end furnishings. This is great news for investors. Yes, you can claim even more tax benefits from depreciation by itemising furnishings separately in a depreciation schedule.

A fantastic example of where our Property Tax team has prepared a depreciation schedule for the property and a separate schedule for the furnishings is for a holiday property at Noosa Heads in Queensland.

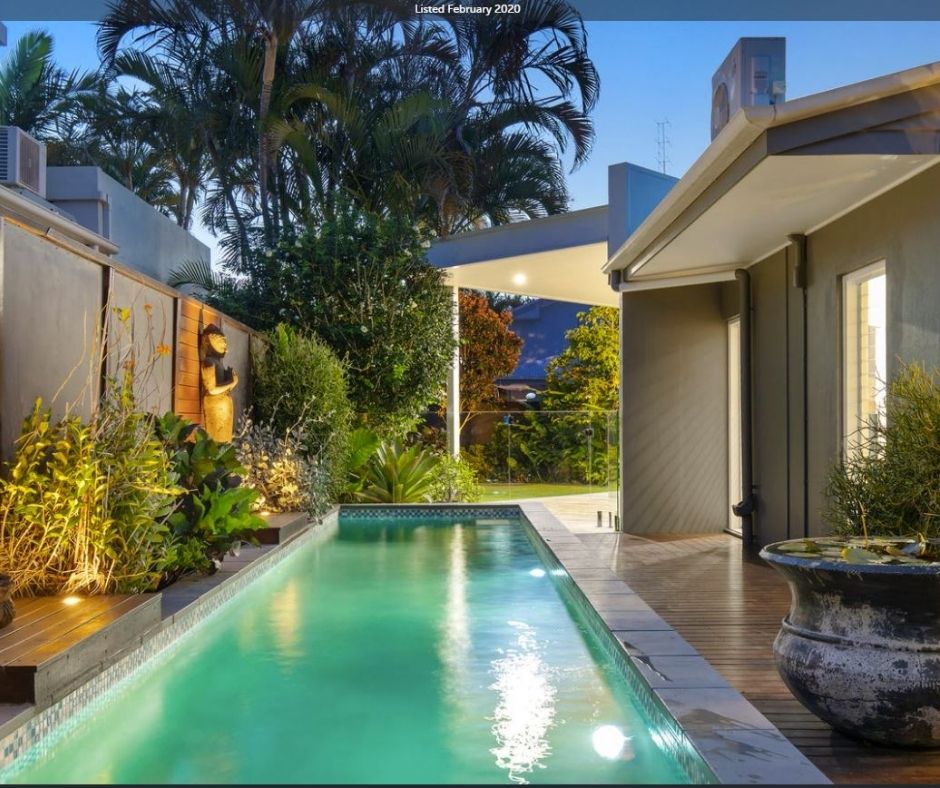

Our team had the privilege of inspecting the luxurious Noosa holiday home featuring wide spaces with generous living zones, and exquisite detail throughout. The home is set over a single level and uses clever design to capture water views. Among the many stunning features are:

- Lap pool and lush tropical garden surrounds

- Dining alfresco with adjustable vergola roof

- Executive study with tropical outlook

- Master bedroom includes ensuite, walk-in robe and private garden

- Travertine flooring throughout

- Air-conditioning and louvres allow tailored temperature control

Our Tax team calculated a total of up to $14,200 in depreciation deductions during the first full year, based on the building allowance and structural improvements to the property claimable under Division 43. Over the next 40 years, our clients could be able to claim a possible $384,000 in depreciation allowances.

As this property is considered second hand (existing) at the time of Purchase, the depreciation on Plant & Equipment items, Division 40, is only applicable to new furniture, and white goods.

The Depreciation Schedule for the new Furnishing found a further $24,500 for the first full year. Again, the diminishing value of these items can be claimed for up to 40 years, totalling approximately $134,126.

Typical Plant & Equipment Items included are:

- Blinds

- Cleaners equipment

- Vacuum cleaner

- Lighting units, removable shades

- Furniture and Fittings – bedding and linen

- Free standing furniture inside and out

- Kitchen equipment including cutlery, crockery and utensils

- Microwave ovens

Investors of high-end holiday properties can claim substantial depreciation deductions for both the Building and Plant & Equipment items. In these cases, obtaining a separate depreciation report for furnishings makes good business sense. To learn how you can benefit, contact our Property Tax team.