Polaris Shines Brightly for Investors

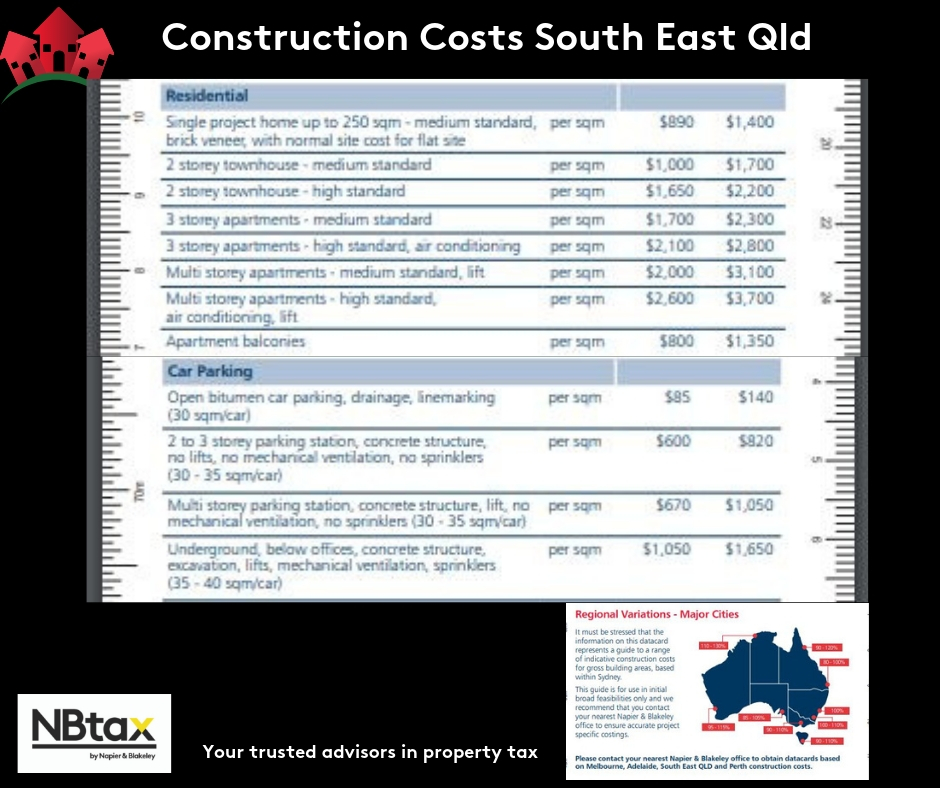

NBtax by Napier & Blakeley had the privilege of working with Apex Investment Alliance to prepare property depreciation reports on behalf of investors purchasing properties in the stunning Polaris Apartments in North Sydney. Located in the popular business district on Berry Street, Polaris is a beacon of light leading the way for luxury residential living.

Characterised by its innovative crystalline form...

.jpg)